What do my rates pay for?

Rates and charges are our main source of income and are used to maintain infrastructure and deliver services and facilities for our community.

With your rates contribution, we deliver and support a huge variety of projects, events, programs and initiatives that diversify our economy, connect our community, protect our environment and support a healthy-active Mandurah, helping to make Mandurah the great place that it is.

Some examples include:

- neighbourhood and community activations and events

- community and business grants

- business training, advice, regulation and support

- community workshops and training

- environmental education and partnerships

- tourism attraction and services

- statutory functions (like planning and building)

- maintenance across our $1.4b asset portfolio, that includes an incredible array of community facilities, that’s our libraries and community centres, sports facilities, performing arts centre, boat ramps... all of the things that help to make our neighbourhoods such a great place to live.

- there’s also an exciting events program with favourites like Crab Fest, our Christmas Pageant, the Lights Trail and Skating in Mandurah. Events like these, help connect our community and boost our local economy.

Read more about the City’s budget.

Why am I paying rates on vacant land?

Rates are charged on all property as per the relevant State Act. As mentioned previously the funds from rates paid are used to fund the City’s infrastructure and services.

Where’s my rebate?

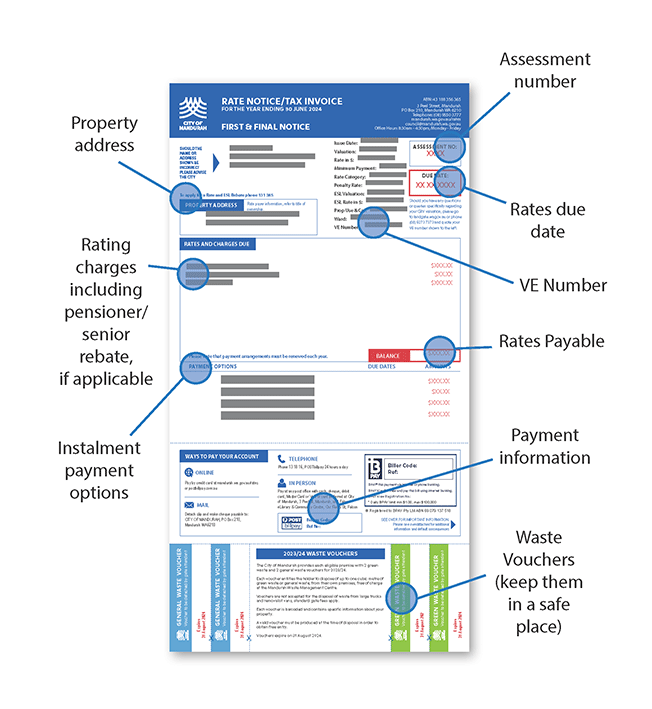

Eligible pensioners and seniors may be entitled to claim a rebate (discount) on their Annual Rates and Emergency Services Levy.If you have registered for this rebate with the Water Corporation, then you will find the discount listed under the RATES AND CHARGES DUE section of your notice called -

Less State Government Rebate – Council Rates

Less State Government Rebate - ESL

To be eligible for a rates rebate (discount) you must:

- Be the owner and live at the property as at 1st July

- Be an owner or person with relevant interest as a Lease for Life occupier as at 1st July

- Hold a seniors card

- Hold a pensioner concession card

- Hold a state concession card

- Hold both a seniors card issued by the Office of Seniors Interests and a Commonwealth Seniors Health Card, or

- Hold a Commonwealth Seniors Health Card, and have registered entitlements with Council or the Water Corporation

To apply for a rates concession contact the Water Corporation on 1300 659 951 or visit the Water Corporation website.

Do I get a reminder when I pay by instalments (option 2 or 3)?

Yes, you will receive a reminder notice approximately one month prior to the due date. However you must ensure that you pay the exact amount shown on the rates notice in one payment, by the due date.

Failure to pay the exact amount shown by the due date will mean that they system won’t recognise your choice to pay by instalment option 2 or 3 and you won’t receive a reminder notice. Additionally you will register as having an overdue balance.

What are the other charges on my rates bill?

A separate charge is levied for your property’s rubbish service for the year. This fee covers both your weekly household rubbish pick-up plus your fortnightly recycling pick-up. This also includes two green waste verge collections and one junk collection per year, plus two green waste tip vouchers and two general waste tip vouchers.

An annual swimming pool inspection fee may appear on your notice if you have a swimming pool or spa. This covers the cost of a compulsory pool barrier inspection every four years at your property.

In addition to the above, all local governments are required to collect the Emergency Services Levy (ESL) for the Department of Fire and Emergency Services (DFES). The ESL funds Western Australia's fire and emergency services, including all career fire stations, volunteer fire brigades, State Emergency Service (SES) units and the multi-purpose volunteer emergency service units.

All local governments are required to collect the ESL on behalf of DFES and have been since 2003/2004.

For more information about the ESL, call DFES on 1300 657 209 or visit the DFES website.

When does the rate year run?

The rate year is per financial year 1 July to 30 June. Rates are due 35 days from the date of issue on notice.

I am about to sell my property and there are still rates to be paid - how is this worked out?

This is completed by your appointed settlement agent at settlement who will apportion the rates accordingly between the buyer and seller.

Why have I received an Interim Rates Account?

If there is a change which affects the value of a property, the owner will be sent an Interim Rates Account. The most common reasons why Interim Rates Accounts are sent are:

- A new property/subdivision (i.e. vacant land)

- A new house/building completed

- Waste/rubbish service charge

- Demolition of a building

- Additions/extensions to a house/building

What should I do if I change my address?

Please advise us promptly in writing of any changes in your address. You can use the Notification of Change of Address Form to fill in the new details. There is an obligation for property owners to ensure that the City has the correct address for service of notices.